Employers should address two key questions with their inclement weather policy: How will you notify employees if the company is open or closed? How will employees be paid if the company is closed all day, or for a partial day?

The method of payment for hourly employees when they miss work due to inclement weather is quite simple. If a non-exempt hourly paid employee does not work, the company is under no obligation to pay the employee. This is true regardless of whether the company is open for business, or if it is closed due to the weather. The Fair Labor Standards Act (FLSA) says that you must pay non-exempt employees only for time “actually worked.” The same holds true when an hourly, non-exempt employee comes in late or leaves early due to the weather. You only have to pay for actual time worked.

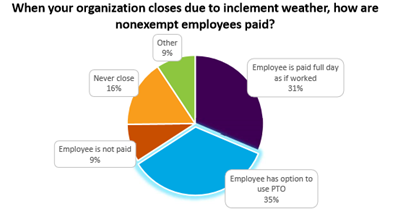

According to our 2022 Workplace Culture and Pay Practices Survey:

For salaried exempt employees, the method of payment is more complicated. They are paid a set salary for all hours worked each week, regardless of quantity or quality. Salaried exempt employees must be paid if they miss work due to weather because the company is closed for business. However, payment to the exempt employee can be made through any applicable and available paid time off plan the company provides.

If the business is closed for an entire workweek, and an exempt employee performs absolutely no work, the employer does not have to pay for that week. However, the FLSA was written in 1938. An exempt employee performing absolutely no work for an entire week with all of the technology at their fingertips is going to be almost all but impossible.

Due to technology and workplace changes as a result of the COVID-19 pandemic, many employees – exempt and nonexempt – are hybrid or fully remote. If a remote exempt employee’s office is “closed” to them (e.g., power outage), there are no specific regulations and limited case law to guide you. If they are truly unable to work at all from home and have no other office they can access, it is recommended to pay as if the business is closed. This should be clearly spelled out in an Inclement Weather policy.

If the business is open, and a salaried exempt employee does not report for work, and performs no work at home, the company may require the employee to utilize available paid time off. In this case if the employee has no available paid time off, it is permissible to dock their pay for the day, because work was available, and the employee chose not to work. If the exempt employee works part of the day, they must be paid for the entire day. It is not permissible to dock an exempt employee for a partial day absence. Additional information on docking the pay of an exempt employee may be found in our Wage and Hour Toolkit.

For salaried non-exempt employees on the fluctuating workweek (receiving half time for overtime), their pay cannot be docked unless they perform absolutely no work in the workweek.

Companies should make their policies known to all employees in advance of inclement weather, and in writing. Keep in mind that companies should balance the legal requirements under the FLSA as well as the employee relations issues of paying or not paying employees for inclement weather days. Our sample Inclement Weather policy can be found in our Employee Handbook Template on our Legal Guides, Tools and Posters page.

If your exempt employees are working outside of NC and SC, it is important to check both state and local law as they may differ. If you have questions about inclement weather policies and practices, please contact a member of Catapult’s HR Advice team.

Written by a Catapult HR Advisor